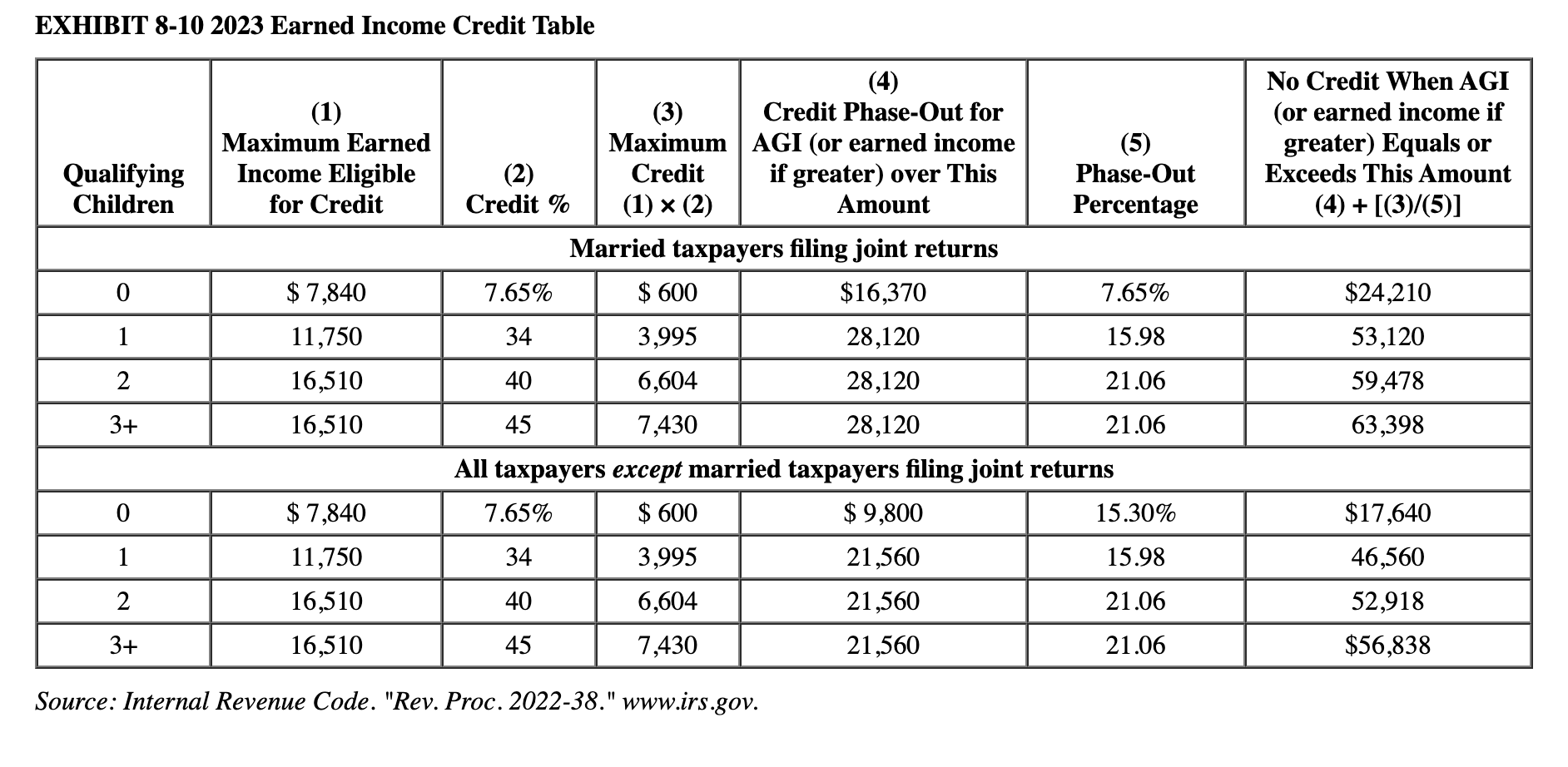

Eic Income Limits 2025 Calendar. For the 2025 tax year (taxes filed in 2025), the max earned income credit. The earned income credit (eic) is a tax credit for certain people who work and have earned.

If you earned less than $66,819 (if married filing jointly) or $59,899 (if filing as single, qualifying surviving spouse or head of household) in tax year 2025, you may qualify for the earned income credit (eic). The earned income credit (eic) is a tax credit for certain people who work and have earned.

Eic Limits 2025 Over 65 Zea Lillis, Maximum credit, calculators, income limits, tables & qualification eligibility.

Eic Limits 2025 Single Zara Engracia, For tax year 2025—meaning the return you file in 2025 —you may qualify for.

Eic Limits 2025 Over 65 Zea Lillis, 2025 & 2025 earned income credit tax (eitc or eic) overview:

Eic Limits 2025 Over 65 Zea Lillis, If you earned less than $66,819 (if married filing jointly) or $59,899 (if filing as single, qualifying surviving spouse or head of household) in tax year 2025, you may qualify for the earned income credit (eic).

Eic Limits 2025 Table Grace Chandra, You can claim an eic if your adjusted gross income is less than certain limits, depending on whether you file as a single or married couple.

Eic Limits 2025 Single Tedda Gabriell, The earned income credit (eic) offers valuable financial support to qualifying.

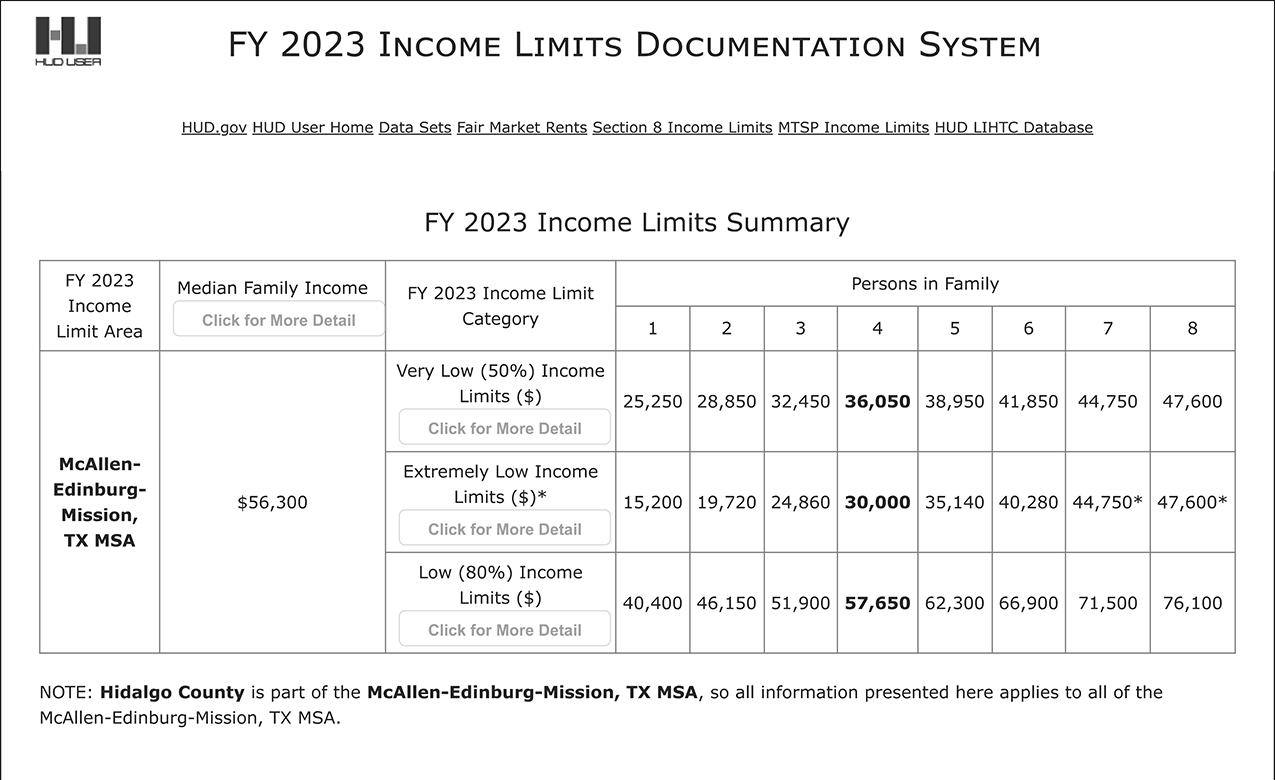

2025 Hud Limits By State 2025 Ema Annnora, Understanding the eic income thresholds is essential.

Eic Limits 2025 Table Grace Chandra, You can claim an eic if your adjusted gross income is less than certain limits, depending on whether you file as a single or married couple.

2025 Eic Limits Tamar Fernande, To claim the earned income tax credit (eitc), you must have what qualifies as earned.

Eic Limits 2025 Married Jointly Alex Lorrin, In 2025 & 2025, changes to the eic income limits are expected.